Contents

When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy one unit of the base currency. When selling, the exchange rate tells you how many units of the quote currency you get for selling one unit of the base currency. The information does not represent an offer of, or solicitation for, a transaction in any investment product. Any views and opinions expressed may be changed without an update. To understand the risks and costs involved, please visit the section captioned “Important Information” and the “Risk Disclosure Statement”. A few high-impact news is announced during the start of a new market session.

This makes sense because, during those times, all the market participants are wheelin’ and dealin’, which means that more money is transferring hands. Keep this in mind if you ever plan to trade during that time period. Each segment may have a different trading calendar and hours of operation.

The New York session/North American trading session.

Volatility varies during different times of the day because of different forex trading sessions. To establish the best times to trade as well as the best forex assets to trade, it is important to understand the different forex trading sessions. The London and the New York forex trading sessions are the largest in terms of volumes traded. Combined, about 70% of daily trading activity occurs during this overlap.

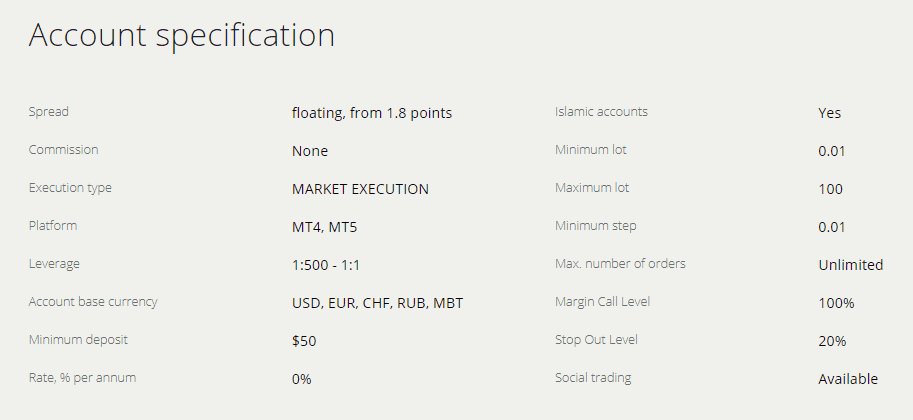

- E-mail The MT4/MT5 ID and email address provided do not correspond to an XM real trading account.

- Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America.

- If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment.

- You would sell the pair if you think the base currency will depreciate relative to the quote currency.

- And Japan doesn’t observe daylight savings, so thank you Japan for keeping it simple.

There can be exceptions, and the expected trading volume is based on the assumption that no major news will come to light. Political or military crises that develop during otherwise slow trading hours could potentially spike volatility and trading volume. While some investors fear market volatility because of the increased risk, forex traders generally prefer greater volatility because they have the potential to earn higher profits. Politics, economic data, and overnight adjustments in interest rates by central banks are the main basic factors influencing currency pairs.

When is the best time to trade forex in Singapore?

Little movement on Friday afternoon + high chances for trend reversal in the second half of the day. XM sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The below image shows the differences in the Average True Range on GBPUSD M15 during different market hours. Interestingly, it also includes a period of NFP release, showing a sharp increase in market volatility. In the European trading session, the GBP is the most traded currency. Thus, the London securities market’s performance heavily influences the GBP’s strength. Approximately 42% of the daily forex turnover is traded during the London session. That is why London is called the forex trading capital of the world.

This time period can see particularly active trading in the USD/JPY, EUR/JPY, GBP/JPY and CHF/JPY currency pairs. With City Index, you can trade forex 24-hours a day from 10pm on a Sunday evening to 10pm on a Friday night. You’ll have the choice of trading 84 global FX pairs, with spreads from just 0.5 points. Volume and volatility, because they reach their peak during these hours!

While the margin position is open, the trader’s assets act as collateral for the borrowed funds. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position . It’s also important to be aware that high trading activity also leads to high volatility. While some traders like the opportunities that volatility can bring, others do not – either way, it’s vital to have a risk management strategy in place. For a retail FX trader, the knowledge of Forex market hours is vital. It is helpful when creating your trading schedule by avoiding that are susceptible to extreme volatility.

Free Weekly Forex Analysis, Signals and Much More…

London has taken the honors in defining the parameters for the European session to date. Now that we have got hold of the forex trading sessions and promised our selves not to over trade. As you try to analyze and study the trading sessions, you will realize that between each forex trading session, there is a period of time where two sessions are open at the same time. As one major market closes the other one opens from time to time.

While the best currency pair for you depends on where you live and trade from, there is a lot of movement between USD and JPY currency pairs. To see the average pip movement for specific currency pairs in real-time, you can use our MarketMilk™ tool. It’s important to remember that the forex market’s opening hours will change in March, April, October, and November, as countries move to daylight savings on different days. TradingHours.com is trusted by world-leading financial institutions, investors, hedge funds, and fintech companies.

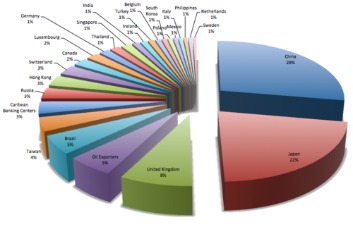

We need to pay more attention to each session, not just how long the meetings overlap. You can imagine the Sydney Open shifting 1 hour as the US adjusts to standard time, but remember, if the US retreats 1 hour, Sydney advances 60 minutes . Right now, you’re probably watching the Sydney Open and asking why it’s two hours EST. The combined share of the top four trading centers, which includes London, New York, Singapore, and Hong Kong amounts to 75% of global FX turnover. These sessions consist of Asian, European and North American sessions, also known as Tokyo, London and New York sessions.

Les sessions de trading sur le forex : Tokyo, Londres, New York

The New York forex trading session starts from 12.00 PM GMT to 8.00 PM GMT. Therefore, the European market hours span from 6.00 AM GMT to 3.00 PM GMT. Usually, when traders talk of the European hours, they mainly refer to the London session. The European session begins when major business hubs open in Europe. For example, in Frankfurt, Germany, trading sessions start at 6.00 AM GMT, while London begins at 7.00 AM GMT.

Avantages de trader le forex

While this ratio offers tantalizing profit opportunities, it comes with an investor’s risk of losing an entire investment in a single trade. The ideal long-term strategy is position trading, which enables you to hold your transactions for weeks or even months at a time. For example, the following shows the hourly volatility of EUR/USD in London and New York sessions. The day of the month that a country shifts to/from DST also varies, confusing us even more.

While each https://topforexnews.org/ functions independently, they all trade the same currencies. This is confirmed based on the fact that in these cases all market participants are spinning and trading, which means more money is going out of hand. Please keep this in mind if you wish to trade during this period at any time.

The vast https://forex-trend.net/ity of retail investor accounts lose money when trading CFDs. Approximately $6.6 trillion is traded on the forex market daily. Over 50% of these daily trades take place when the New York and London sessions overlap, making this one of the most popular times to trade to take advantage of the high turnover. 78.17% of retail investor accounts lose money when trading CFDs with this provider. The European forex trading session is the largest and the world’s most volatile market for trading currencies. It has a turnover of 34.1% market share of the daily forex volume.

We’re also a community of traders that support each other on our daily trading journey. Sign up for TradingHours.com’s Weekly Digest – a comprehensive summary of upcoming holidays impacting financial markets this week – delivered straight to your inbox every Monday at 6am ET. Define whether high or low volatility works best for you and take note of the session overlaps.

Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual https://en.forexbrokerslist.site/ may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold The Forex Geek and any authorized distributors of this information harmless in any and all ways. The most popular Forex pairs to trade during the Sydney session are AUD/NZD, USD/CHF, AUD/JPY, GBP/USD, EUR/USD, and USD/JPY. To further confuse us, the dates of the months in which countries switch to and back to daylight saving time have also changed.