This is because the net effect of losing a tax shield is losing the value of the tax shield but gaining back the original expense as income. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible. D&A is embedded within a company’s cost of goods sold (COGS) and operating expenses, so the recommended source to find the total value is the cash flow statement (CFS). It is necessary to understand the importance of the concept of depreciation tax shield equation in the corporate environment as a temporary benefit to save taxes.

Standard Tax Deductions

Assume that the corporate tax is paid one year in arrear of the periods to which it relates, and the first year’s depreciation allowance would be claimed against the profits of year 1. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, “EBT”) for each period, thereby effectively creating a tax benefit. The Depreciation Tax Shield refers to the tax savings caused from recording depreciation expense.

Understanding a Tax Shield

The Internal Revenue Service (IRS) allows businesses and individuals to deduct certain qualified expenses, thereby lowering their taxable income and their ultimate tax liability. This tax-efficient investment method is used particularly by high-net-worth individuals and corporations that face steep tax rates. Understanding the concept of a tax shield can have a significant impact on your financial decision-making. By taking advantage of legitimate deductions, tax credits, and depreciation allowances, businesses and individuals can minimize their tax liability and retain more of their hard-earned income. It’s important to consult with a tax professional or financial advisor to understand the specific tax provisions applicable to your situation and optimize the use of tax shields effectively. By doing so, you can make informed financial decisions and potentially better secure your financial future.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

A tax shield refers to a legal and allowable method a business or individual might employ to minimize their tax liability to the U.S. government. Properly employed, tax shields are used as part of an overall strategy to minimize taxable income. Lower-income taxpayers can benefit significantly from this if they incur larger medical expenditures. Therefore, while the company paid $100,000 for the machinery, the actual after-tax cost is effectively lowered to $73,000 ($100,000 – $27,000) thanks to the depreciation tax shield. This is one of the ways companies manage their tax liabilities and improve cash flows. Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations.

Examples

In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances. For donations to qualify, they must be given to an approved organization. The term “tax shield” references a particular deduction’s ability to shield portions of the taxpayer’s income from taxation. Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year. To increase cash flows and to further increase the value of a business, tax shields are used.

- Just like the name implies, it shields you from tax obligations before the government.

- For instance, if you expect to have a high income next year(s), it might be wise to hold on to be able to lower your income in the future and avoid paying a higher tax rate.

- Tax shields are an important aspect of business valuation and vary from country to country.

- It’s calculated by multiplying the depreciation expense by the tax rate.

In the above example, we see two cases of the same business, one with depreciation and another without it. It is easy to note the difference in the tax amount payable by the business at the end of each year with and without the annual depreciation tax shield. If we add up all the taxes, the amount is substantial, which could be saved if the business had charged depreciation in the income statement. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit.

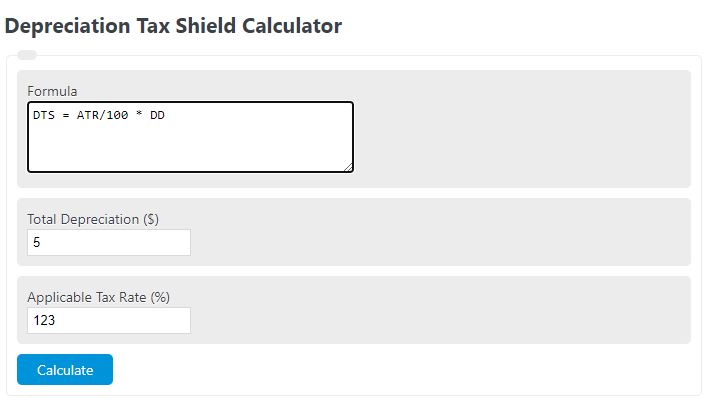

This will become a major source of cash inflow, which we saved by not giving tax on depreciation. The concept of annual depreciation tax shield is identified as an important factor during financial decision-making by the management in case the business is highly capital-intensive. The business operation will involve the use of assets of larger value resulting in a substantial amount of depreciation being deducted from the taxable income. Therefore, it is important to understand the formula used to calculate depreciation tax shield, as given below. For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields.

The payment of the interest expense is going to ultimately lower the taxable income and the total amount of taxes that are actually due. Since adding or removing a tax shield can be significant, many companies consider this when exploring an optimal capital structure. An optimal capital structure is a good mix of both debt and equity funding that reduces a company’s cost of capital and increases its market value. The tax shield refers to the amount of tax that has been saved by claiming depreciation as an expense. It’s calculated by multiplying the depreciation expense by the tax rate. Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%.

The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment. The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields. Also, the value of a levered firm or organization horizontal equity vs vertical equity exceeds the value of an equal unlevered firm or organization by the value of the interest tax shield. Meanwhile, the company maintains its own depreciation calculations for financial statement reporting, which are more likely to use the straight-line method of depreciation.